Understanding Long Term Care Legislation

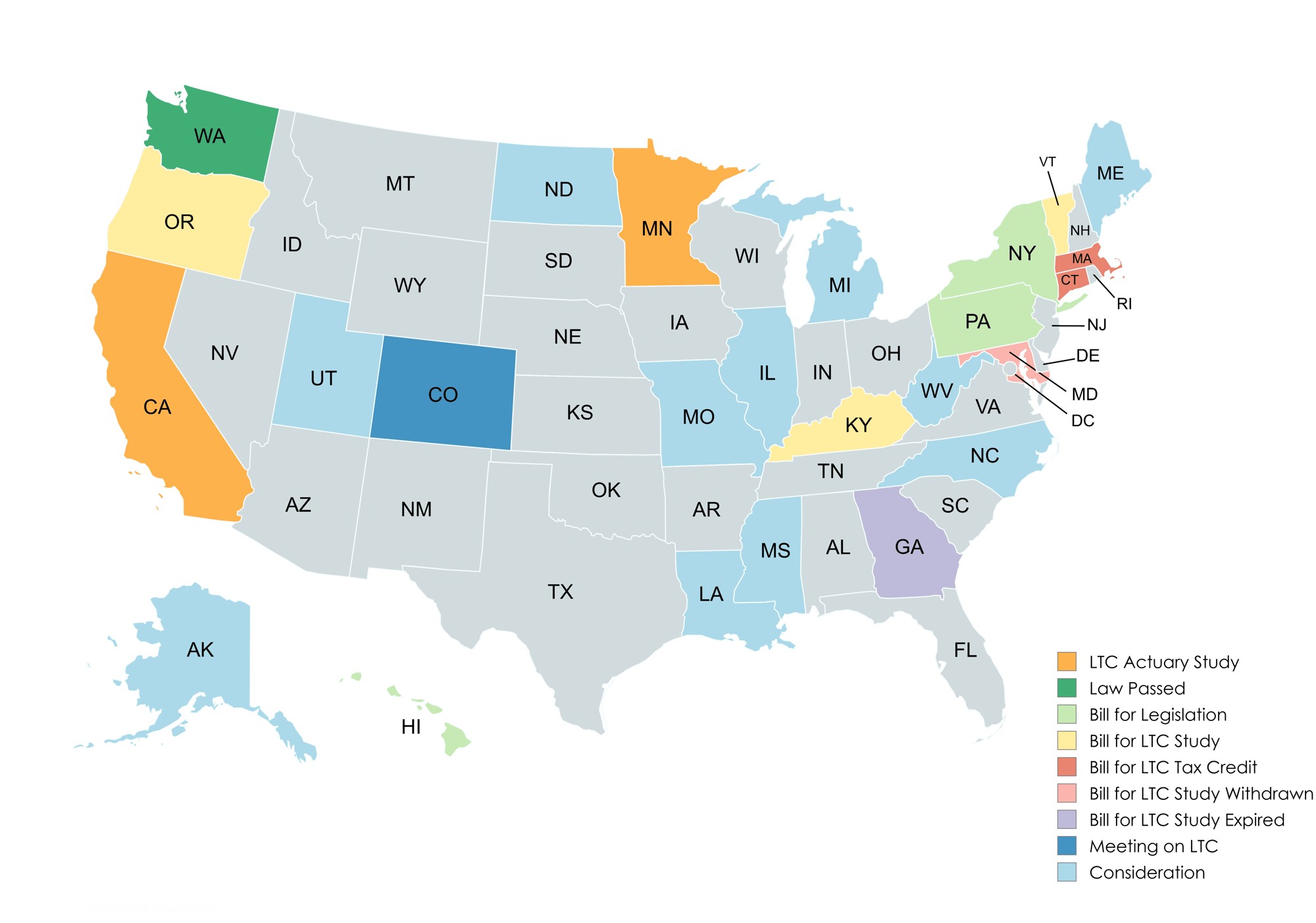

In 2019 the Washington state legislature established the Washington Cares Fund, the nation’s first publicly funded long-term care benefit for eligible workers, to address the future LTC crisis posed by an aging population. This sparked a national conversation about the need for long-term care planning as state Medicaid systems struggle to cover the 70% of Americans that will need LTC in their lifetimes, only 10% of whom have insurance that will pay for it. Many other states have followed suit and are in various stages of evaluating public LTC programs of their own. Depending on how each state designs their plans, qualifying LTC insurance policies may allow individuals to opt out of the payroll tax.

Federal

Federal | H.R 8820 Improving Access to Long-Term Care Insurance Act bill.

Propose an above-the-line deduction for premiums paid on LTC insurance in an effort to make LTC insurance more affordable and accessible.

Federal | WISH ACT - HB 2082

- Catastrophic LTC program available after a waiting period

- Waiting period dependent on an individual’s income

- Private coverage may be needed to cover the waiting period

- Does not include a funding source

California

California | Feasibility Study - Assembly Bill 567

- Click here for the Oliver Wyman Feasibility Report FAQ

- Click here for an Actuarial Analysis by Oliver Wyman

- Click here for the AB 567 Actuarial Analysis and Next Steps

- Click here for the AB 567 Clarifications

2019 - the bill establishes The Long-Term Care Insurance Task Force to explore the feasibility of developing and implementing a culturally competent statewide insurance program for long-term care services and supports. This includes the design of the program including eligibility, financing, benefits, and other key topics related to administration.

December 2022 - the Task Force finalized their Feasibility Report, in which five (5) plan designs were proposed.

December 2023 - Oliver Wyman completed their analysis of the 5 plan designs and provided to the legislature.

January 2025 - The next step would be that the legislature, department of insurance, or Governor's office decides if they want to move forward with the task force recommendations.

| Plan Design |

Lifetime Plan Benefit |

Monthly Benefit |

Estimated Contribution Rate |

|

| Equities Investments | U.S. Treasuries Investments | |||

| 1 | $36,000 | $1,500 | .60% | .79% |

| 2 | $110,400 | $4,600 | 1.15% | 1.61% |

| 3 | $36,000 | $3,000 | .65% | .87% |

| 4 | $81,000 | $4,500 | 1.60% | 2.16% |

| 5 | $144,000 | $6,000 | 3.0% | 3.94% |

Connecticut

Proposed Bill - CT S 184

In January 2025 Connecticut proposed CT S 184, a new tax credit for premiums paid for long-term care insurance. It also incorporates consumer protection measures to ensure transparency, education, and acknowledgment of understanding the product and its risks.

Prior Bills

Georgia

Proposed Bill - HR 1276

Proposed constitutional amendment to create the Long-Term Services and Supports Trust Fund to reimburse LTC services incurred by eligible individuals.

Hawaii

Proposed Bill - SR 19- Resolution passed the senate and will move forward

- Request for the HI Tax Review Commission to identify possible means to implement state LTC financing program which would provide universal and affordable LTC care for all eligible state residents

Kentucky

House Joint Resolution 100

A joint resolution directing the Department of Insurance to create a task force to explore the feasibility of implementing a statewide insurance program for long-term care services and supports.

Maryland

Proposed Bill HB0349

Legislation proposed that calls for a study to be conducted on LTC Insurance & State Programs. The bill requires the Department of Aging to contract with an independent consultant to complete an insurance study on public and private options for leveraging resources to help individuals prepare for long-term care services and support needs; and requiring the Department to submit an interim report by December 31, 2024 summarizing the progress of the study and a final report by December 31, 2025 to the Governor and General Assembly on the results of the study.

Massachusetts

Proposed Bill S.476: An Act Establishing a Special Commission on a Statewide Long-Term Services and Supports Benefit Program. Referred, pursuant to an order adopted by the two branches, to the committee on Aging and Independence.

Proposed Bill H.792: An Act Establishing a Special Commission on a Statewide Long-Term Services and Supports Benefit Program. Referred, pursuant to an order adopted by the two branches, to the committee on Aging and Independence.

Milliman actuary report: click here

- Page 4 of the Milliman actuary Report:

- Page 7 of the Milliman actuary report:

Minnesota

Feasibility Study - HF 1664

This feasibility study proposes a transformative long-term care service and support financing study called, “Own Your Future.” The Minnesota Department of Human Services Aging and Adult Services Division has contracted with FTI Consulting Inc. (FTI) to conduct an innovative study aimed at increasing access to long-term care services and supports (LTSS) for Minnesota’s older adult population.

December 2024 - Legislative task force on aging released final recommendations.

- Prioritizes establishment of a new

agency called "Cabinet on Aging" to support Aging and LTC issues focusing on LTC solutions, including potentially considering a state option

New York

Senate Bill S1779 | Introduced January 8, 2025. Enacts the "New York long term care trust act" and establishes the New York long term care trust program.

Assembly Bill A1499 | Introduced January 10, 2025. Enacts the "New York long term care trust act" and establishes the New York long term care trust program.

New York has both a Senate and Assembly bill. Both must pass a bill before the Governor can consider it for signature.

Oregon

Senate Bill 34

On January 13, 2025 Oregon introduced OR S 34. The bill requires the Department of Human Services to study long-term care. It directs the department to submit findings to the interim committees of the Legislative Assembly related to health no later than September 15, 2026.

Pennsylvania

Proposed Bill -HB 844

Introduced in March, 2023 to provide for long-term care services and supports, establishes the Long-Term [Care] Services and Supports Commission, the Long-Term [Care] Services and Supports Council and the Long-Term [Care] Services and Supports Trust Fund; imposing duties on the Department of Human Services and the Department of Revenue; and imposing a payroll premium.

Vermont

Proposed Bill - H.120

On January 26, 2025 Vermont introduced VT H 120. The bill proposes requiring the Secretary of Administration to study and design a trust fund that will provide for long-term care for certain Vermont residents, and to propose legislation to statutorily create this fund.

Washington

Law Passed | WA Cares Fund

- 2019 - The WA Cares Act became law

- Private Insurance Opt-Out

- Those who had private long-term care insurance on or before Nov. 1, 2021, were able to apply for an exemption from the WA Cares Fund from Oct. 1, 2021, until Dec. 31, 2022. Those who applied for this exemption, and were approved, are permanently exempt from WA Cares. This opt-out provision is no longer available for new applicants.

- Looking for your exemption approval letter?

- Log in to your WA Cares exemption account and click on the ‘Exemption ID’ of your approved exemption to view and download a copy.

- Call WA Cares Fund at 833-717-2273 to request more copies be mailed to you.

- Looking for more information on exemptions?

- Find answers to frequently asked questions about exemptions in the WA Cares Fund Help & Support Center.

- You can reach ESD's WA Cares Fund representatives at wacaresexemptions@esd.wa.gov or by calling (833) 717- 2273.

- Private Insurance Opt-Out

- January 2023 - Beginning January 1, 2023, Washington workers became eligible for exemptions by applying for an exemption from WA Cares if any of the following apply to them:

- Live outside of Washington

- Are the spouse or registered domestic partner of an active-duty service member of the United States armed forces

- Have a non-immigrant work Visa

- Are a veteran with a 70% service-connected disability rating or higher. Veterans with a 70% service-connected disability rating or higher will receive a permanent exemption.

- If your exemption is approved

- You will receive an exemption approval letter from the ESD, which you will need to present to all your current and future employers.

- Once you provide your approval letter to your employers and the effective date of your exemption has passed, your employers must stop withholding premiums. If your employers continue to withhold premiums, they must return them to you.

- If you fail to present your approval letter to your employers, any premiums that may have been collected will not count toward benefit eligibility and employers have no responsibility to return those premiums to you.

- Exemptions will take effect the quarter after your application is approved.

- To apply for an Exemption: Click here

- For WA Cares Fund Assistance Click here

- July 2023 - The WA Cares Fund payroll tax took effect on July 1, 2023.

- June 2024 - The following changes to WA Cares Fund are effective:

- July 2026 - Washington workers can choose to continue participating in the WA Cares Fund if they move out of state. Click here for more information.

- July 2030 - Benefits will become available for out-of-state participants. Click here for more information.

- November 2024 - State ballot initiative 2124, proposed to make the WA Cares Act optional, did not pass on Nov. 5, 2024.

Bills Currently Proposed

- HB 1025 - Prefiled for Introduction. December 10, 2024.

- AN ACT Relating to reopening the exemption from the long-term services and supports trust program for employees who have purchased long-term care insurance; and amending RCW 50B.04.085.

- Proposes the following amendments - An employee who attests that the employee has long-term care insurance purchased before November 1, ((2021)) 2027, may apply for an exemption from the premium assessment under RCW 50B.04.080. An exempt employee may not become a qualified individual or eligible beneficiary and is permanently ineligible for coverage under this. The employment security department must accept applications for exemptions only from October 1, 2021, through December 31, ((2022)) 2028

- HB 1026 - Prefiled for Introduction. December 10, 2024.

- AN ACT Relating to protecting spouses by allowing the sharing of 2 benefits under the long-term services and supports trust program; and adding a new section to chapter 50B.04 RCW

- AN ACT Relating to protecting spouses by allowing the sharing of 2 benefits under the long-term services and supports trust program; and adding a new section to chapter 50B.04 RCW

- SB 5291 - Passed House and Senate as of April 22, 2025.

- This bill modifies the existing long-term care services and supports program by expanding coverage options for out-of-state participants, clarifying eligibility requirements, and creating a new regulatory framework for supplemental long-term care insurance.

Category

Details

Eligibility Requirements

Must need help with 3+ activities of daily living for 90+ days and meet one of the following:

• Lifetime access: 10 years of contributions

• Early access: contributed for 3 of last 6 years

• Nearing retirement: Born before January 1, 1968 and contributed for at least one year. Partial Pro-rated benefit; 10% for each year contributed.Opt-in

Allows workers to rescind their private insurance exemptions and opt in. Starting January 1, 2026 - July 31, 2028. Pilot Program

Limited pilot program in 2026 to asses the programs process and systems capabilities with up to 400 people in 4 counties (Thurston, Lewis, Mason, and Spokane). Starts January 2026 until the formal launch, July 1, 2026.

Exemption Categories (opt-out)

• Active-duty military in civilian roles

• Nonimmigrant visa holders - effective 1/1/2026, WA Cares will automatically exempt non-immigrant work visa holders from paying WA Cares premiums. Employees can still participate in the program if you inform your employer(s), in writing, that you

would like to continue making contributions. Click here for more information.

• Private LTC insurance holdersSupplemental Private LTC Insurance

Must provide at least 12 months of coverage after WA Cares Benefits are exhausted.

Move out of State

To become an out-of-state participant, workers must have contributed to WA Cares for at least three years (in which they worked at least 500 hours per year) and must opt in within a year of leaving Washington.

Implementation Timeline

• Signed into law: May 20, 2025

• Effective: Jan 1, 2026

• Benefits available: July 1, 2026

- This bill modifies the existing long-term care services and supports program by expanding coverage options for out-of-state participants, clarifying eligibility requirements, and creating a new regulatory framework for supplemental long-term care insurance.

- HB 1415 - Introduced. January 20, 2025

- Implementing the recommendations of the long-term services and supports trust commission.

- Implementing the recommendations of the long-term services and supports trust commission.

- HB 1578 - Introduced. January 24, 2025

- Repealing the long-term care services and supports trust program.

- Repealing the long-term care services and supports trust program.

- SJR 8201 - 2025-26 - Filed with Secretary of State. February 20, 2025

- Amending the Constitution to allow the state to invest moneys from long-term services and supports accounts.